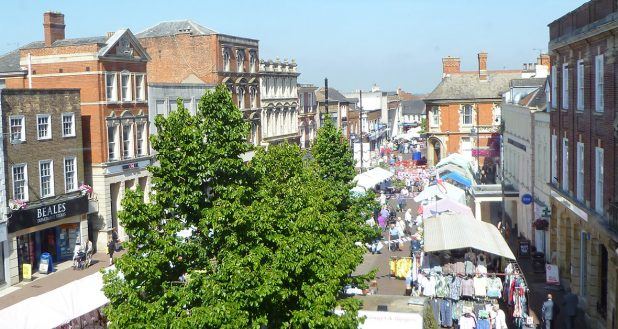

The saga of South Holland market charges is back on the district council agenda at a meeting of the Cabinet next week.

Members had decided in the height of the pandemic earlier this year to no longer have market stalls erected for traders in Spalding – a move that caused a backlash.

Now there are recommendations to review the fees and one option is to bring them in line with neighbouring authorities.

Currently the traders in Spalding have not been paying any fees and it will remain that way until at least the end of November.

“Now that stalls are not being provided, the fees require a review to ensure they are competitive and attract traders to our markets. Alongside this, the differences in our markets must be acknowledged.

“Spalding can attract a higher footfall on a Tuesday than our other markets, but on a Saturday we have seen reduced traders and footfall,” says the report.

Members will be told on Tuesday that there is a price difference in King’s Lynn with Tuesday pitches being slightly more expensive for traders than the town’s Saturday market.

“King’s Lynn charge differently for their Tuesday and Saturday markets which provided some food for thought as to whether it may be appropriate to consider altering the charges for Spalding Tuesday and Saturday markets in a similar way,” says the report to go before cabinet.

Option one would see Tuesday traders pay £1.40 per foot as a casual and £1.30 on Saturday.

Regular traders would pay £1.20 per foot on Tuesday and 90p on Saturdays.

The second option would see all market fees in the district the same, with no difference on days or venues.

This is the preferred option of the traders and is on the agenda despite last month SHDC’s Policy Development Committee voting against considering it.

The fees would be 61p per foot for casual stalls in all towns and 51p for regulars.

The third option for members to vote on is to do nothing and leave the fees as agreed at cabinet on June 16, £11.20 for a 2.4m stall or £14 for a 3m pitch.

The report says the first option would see fees ‘reflective of the circumstances of individual markets’.

Option two ‘aligns the pricing’ to allow some consistency.

“The future of the markets will be considered in line with the ongoing Market Town Programme,” it adds.

The financial difference between options one and two is £11,377 a year based on current trader numbers.

The Voice of Spalding and South Holland

The Voice of Spalding and South Holland